The 5th International Conference on Financial Technology successfully concluded on September 24, 2024, in Singapore. The event received strong support from leading institutions, including the National University of Singapore, Nanyang Technological University, Singapore Management University, and Shanghai Jiao Tong University. It brought together experts, scholars, and industry representatives from China, Singapore, France, Italy, Thailand, the UAE, and Malaysia to discuss the latest trends, innovations, and challenges in financial technology.

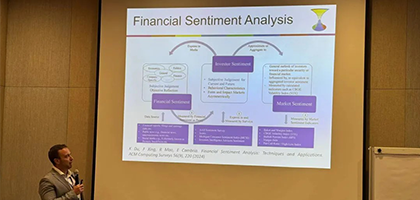

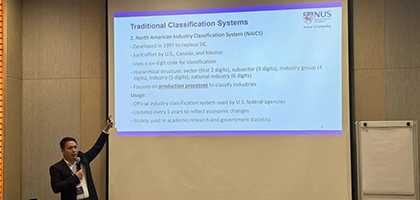

With a focus on “Financial Technology,” the conference featured keynote speeches, oral presentations, and poster sessions. Participants shared cutting-edge research and practical applications in areas such as AI, machine learning, the metaverse, and large language models, sparking engaging discussions among attendees.

ICFT 2024 Conference Proceedings

ICFT 2024 received submissions from researchers in over 20 countries within the field. Following a rigorous peer-review process, all accepted papers were published by Springer in the prestigious Communications in Computer and Information Science series (CCIS, volume 2437; ISSN: 1865-0929). The proceedings have also been successfully indexed in EI Compendex, Scopus, and other leading academic databases.